The recent and rapid advances in artificial intelligence (AI) and machine learning (ML) have the potential to change the way we all work: for the CFO, this could be the key to transforming Finance from the scorekeeper that tracks value to the futurist that actually creates and grows value.

“It is going to be profound,” says Sayan Chakraborty, co-president at Workday, considering the impact AI and ML will have on the workplace and the economy. Already, 61% of businesses have begun their journey to AI adoption, and half of businesses expect to invest more in AI over the next five years. The C-Suite is looking at the arrival of artificial intelligence and machine learning with a mixture of excitement and trepidation, and few are looking at it harder than the CFO. “They can’t ignore it,” asserts Chakraborty. “They have to be a much stronger outward partner with the CIO.”

Sayan Chakraborty

The CFO is now expected to be a trusted advisor at the business level for where the company needs to go.

Co-President at Workday

The problems facing the modern CFO are always ‘and’ problems: You have to do this ‘and’ that. CFOs have traditionally been viewed through the lens of closing the books, paying the bills, complying with legal regulations. “That’s all still true,” enthuses Chakraborty, “And the CFO is now expected to be a trusted advisor at the business level for where the company needs to go.” This is the ‘Future CFO’: it’s a workload combination that powerful tools like AI and ML can actively enable.

Even so, finance remains a slower adopter, with 47% of finance teams yet to begin piloting AI. This could be down to concerns, notably that a lack of transparency with AI and ML will weaken security and compliance. Certainly, the ethics around AI is a hotly debated topic, but when applied professionally and responsibly, AI can actually strengthen security and compliance by spotting anomalies and security threats. Another big concern for finance is readiness: one third of finance leaders say their departments are the least prepared for AI integration; 30% don’t think their employees have the technical skills to work effectively with it.

48%

of finance leaders are excited at the prospects of embracing AI – 39% consider it a complete gamechanger

Despite this, 48% of finance leaders are excited at the prospects of embracing AI – 39% consider it a complete gamechanger. For many, the biggest and most immediate benefit is increased productivity. “What machine learning offers,” says Chakraborty, “is the elimination of a lot of repetitive work.” And this is clear in the case of the CFO. Taking the traditional finance task of ‘closing the books’, Chakraborty notes that humans are not designed to trawl through hundreds of thousands of lines of transactions to spot a possible mistake. “Computers are,” he adds. “And they don’t get tired, and they don’t run out of time.”

Sayan Chakraborty

What machine learning offers is the elimination of a lot of repetitive tasks.

Co-President at Workday

With finance moving to a continuous close, where transactions and accounting are processed in real time, machine learning can deliver immediate benefits. “Rather than waiting until the end of the quarter to find problems, machine learning algorithms identify them as they happen,” explains Chakraborty. AI and ML stands between operating at a more strategic level and all the background noise, tirelessly looking for anomalies and patterns to say ‘Hey, pay attention to this one.’ By automating essential but time-consuming tasks, the finance team is available to fulfil a wider strategic role as a trusted advisor to serve the business.

AI And ML

stands between the CFO and all the background noise, tirelessly looking for anomalies and patterns

40% of finance leaders believe that AI will enable them to deliver more strategic value. Faced with questions like “What’s the right investment opportunity?” or “Should we build this product or enter in that market??” the CFO can apply their expertise to guide the board’s business decisions. “That requires not just a lot of time,” says Chakraborty, “but a lot of data analytics.” And 32% of finance leaders see data driven decision-making as an immediate benefit of AI.

40%

of finance leaders believe that AI will enable them to deliver more strategic value

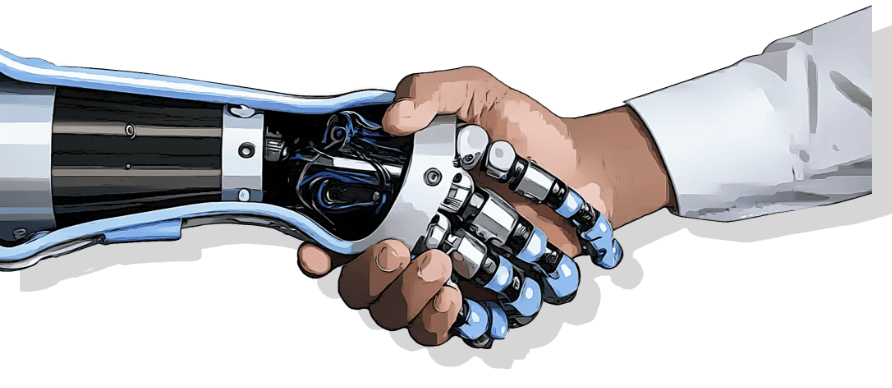

Using AI to get an unequivocal decision on strategic business questions is for most, dangerously ambitious: we all want to see a human as the final decision point. It’s about augmenting people, not replacing them. What AI can do is highlight your best options and flag possible problems.

We all want to see a human as the final decision point. It’s about augmenting people, not replacing them.”

“If I’m looking at everything, I’m looking at nothing,” explains Chakraborty. But AI can look at everything. “It can say, I ran this scenario 10,000 times and in the few that worked out, here’s what mattered.” Such insights add enormous value and drive better decision making at every level.

Sayan Chakraborty

If I’m looking at everything, I’m looking at nothing, but AI can look at everything

Co-President at Workday

AI has the potential to transform the way the CFO, and the whole C-Suite, operates. It delivers those two most precious elements: precision and time. “It allows people to focus on more business-critical activities,” says Chakraborty. “It looks at all the data the business is generating to quickly and correctly identify trends, patterns, challenges, threats, and opportunities, signalling ‘these are the things you should be looking at.’” For finance, it is the ‘and’ enabler: the essential tool to transform the future CFO into a forward-looking business advisor dynamically supporting the growth of their organisation.